It's Wonderful To Learn About Property Shelling out

When you have any kind of very long-array fiscal goal under consideration, investing is probably going to be required to do it. Whether or not your dream is retirement or delivering a child to college, you might be very best off letting your hard earned dollars grow by itself after a while. Continue reading to learn some basics about shelling out your finances.

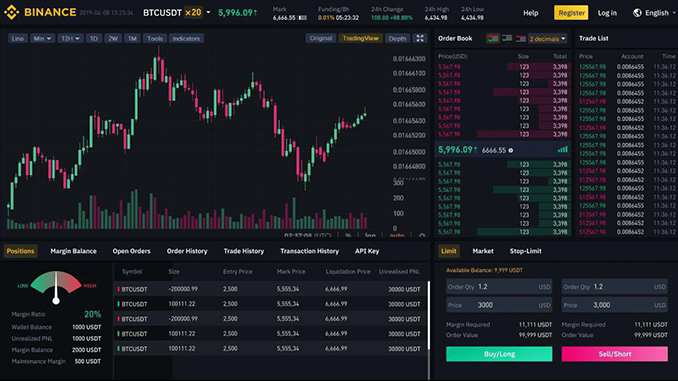

Before beginning investing, acquire supply in the market place and do your homework on components. Look at in between 50 along with a hundred or so components in your community of interest. Do a comparison using good notice using as well as a distributed page. Hire requirements, prices and restoration financial budgets should be factors you're contemplating. 선물거래 will help you make a decision what deals work most effectively.

Advertising is going to be crucial to ensuring your success. Advertising and marketing is exactly what provides your prospects. Without having reliable prospects, you are not going to discover great deals on attributes. Therefore, if some thing will not be operating in your expense strategy, consider your marketing strategy initial to view what is going on and so what can be modified.

Speak to other real-estate traders. It's vital that you get in touch with other folks and have guidance from these more knowledgeable than on your own. Their expertise can keep you from producing errors and save you some cash. You can find many others through the Internet. Get community forums being productive on and find gatherings in your neighborhood.

You really should use a home control assistance. This can cost a tiny and can be very convenient over time. These firms will help you find decent renters, and in addition care for any injuries. This frees up time to consider far more properties.

Don't enter into real-estate investing except if you're capable to possess some backup income. Location cash apart to cover slight repairs. One other good reason behind possessing extra income is in the event you can't look for a ideal renter at the earliest opportunity. You continue to will need to contemplate the expense of property even when no-one is lifestyle there.

Search for properties that will be popular. Really quit and consider what the majority of people will likely be looking for. Look for moderately valued attributes on peaceful streets. Actively seeks properties with garages and two or three rooms. It's constantly crucial that you take into account exactly what the typical man or woman will probably be looking for in the home.

Status is important inside the investing entire world. As a result, generally notify the truth and try not to make any foes. Most importantly, follow through on what you say you are going to do. In case you are unclear whenever you can make a move, do not make your assert to start with. Your track record could experience and affect your organization because of this.

Can be your area going through a house importance improve? Would you see openings the location where the locations are increasingly being rented? These are some questions to ask on your own. You would like to make sure you will discover a demand for rentals in the community where you purchase.

Generally monitor your renters. Being aware of who you will be hiring your components to is important. Have a backdrop check out. Make certain they don't use a spotty and abnormal historical past with spending their hire by the due date. Learning regarding your tenant's history will save you a great deal of difficulty in the future.

Whenever you purchase real estate, take care not to more than-invest. You happen to be more well off starting up with a small-scale than getting in around your head at first. You don't want to deplete your financial savings. Tend not to allow it to be your full-time task instantly. Once you have been productive, you are able to modify your strategy.

It's attractive to leap right into the real estate market, but that technique can be extremely unsafe. Instead, you should begin with modest assets, then improvement to even bigger ventures. In this manner, you can expect to usually have an economic support and should never be wiped out by one particular misstep or streak of awful marketplace good luck.

Stay away from any hoopla with regards to a a number of component of home. It does not matter how excellent the sales pitch seems. It is perfectly up to anyone to do thorough study around the part of property to ensure that it is actually effectively represented. Acquiring residence dependent purely on hype is surely an risky choice.

Recurrent Online investment discussion boards. You may have the ability to learn a whole lot from all those with plenty of practical experience. You will get the opportunity to ask questions from people who have been investing for many years. This sort of investment local community is normally really supportive. New brokers frequently discover these organizations being really valuable.

Generally understand the dangers that you are currently working with. Normally, the larger the danger, the larger the probable payoff is going to be. But together with that greater risk also arrives a bigger probability of not making any funds whatsoever. So measure the chance degree and ensure it is in your convenience area.

Try to find ventures offering taxation positive aspects. According to the expenditure enterprise, there can be a number of taxes benefits. Connections are a good demonstration of a good investment that be appealing because the benefits upon them may be tax exempt. So factor into all those saving when determining the benefits that the endeavor may have for yourself.

Make your expectations realistic. Don't rely on investments causing you to rich. That's a very less likely outcome. Keep the expectations reasonable kinds. You are able to still make plenty of dollars from ventures, even if it is unlikely as a lot of money. Congratulate yourself for modest successes as opposed to permitting them to dissuade you.

If you are buying stocks, then become knowledgeable about how the highs and lows from the marketplace are. Then when your stocks success a "downward" period, you wont be panicked and try to market confused. Tugging your hard earned dollars out too rapidly is a kind of blunder made by novice traders.

At some stage in your daily life you are going to think about big financial objective you wish to do inside the considerably long term. This can be creating your nest egg or delivering a young child to a excellent university. It is possible to tackle such pricey goals by committing dollars as time passes. Take advantage of the knowledge and ideas with this write-up to make your long term dreams an increasing actuality.