It's Wonderful To Discover Real Estate Property Investing

For those who have any sort of very long-array financial objective at heart, investing is likely to be needed to achieve it. No matter whether your dream is retirement life or mailing a youngster to university, you might be finest away from permitting your hard earned money develop on its own over time. Please read on to understand some basic principles about committing your money.

Before you begin making an investment, consider stock of your market place and shop around on components. Have a look at among 50 as well as a one hundred properties in the community of great interest. Do a comparison employing very good be aware getting plus a distributed sheet. Rent payments requirements, pricing and maintenance finances must be aspects you're contemplating. This will help decide what deals are the most effective.

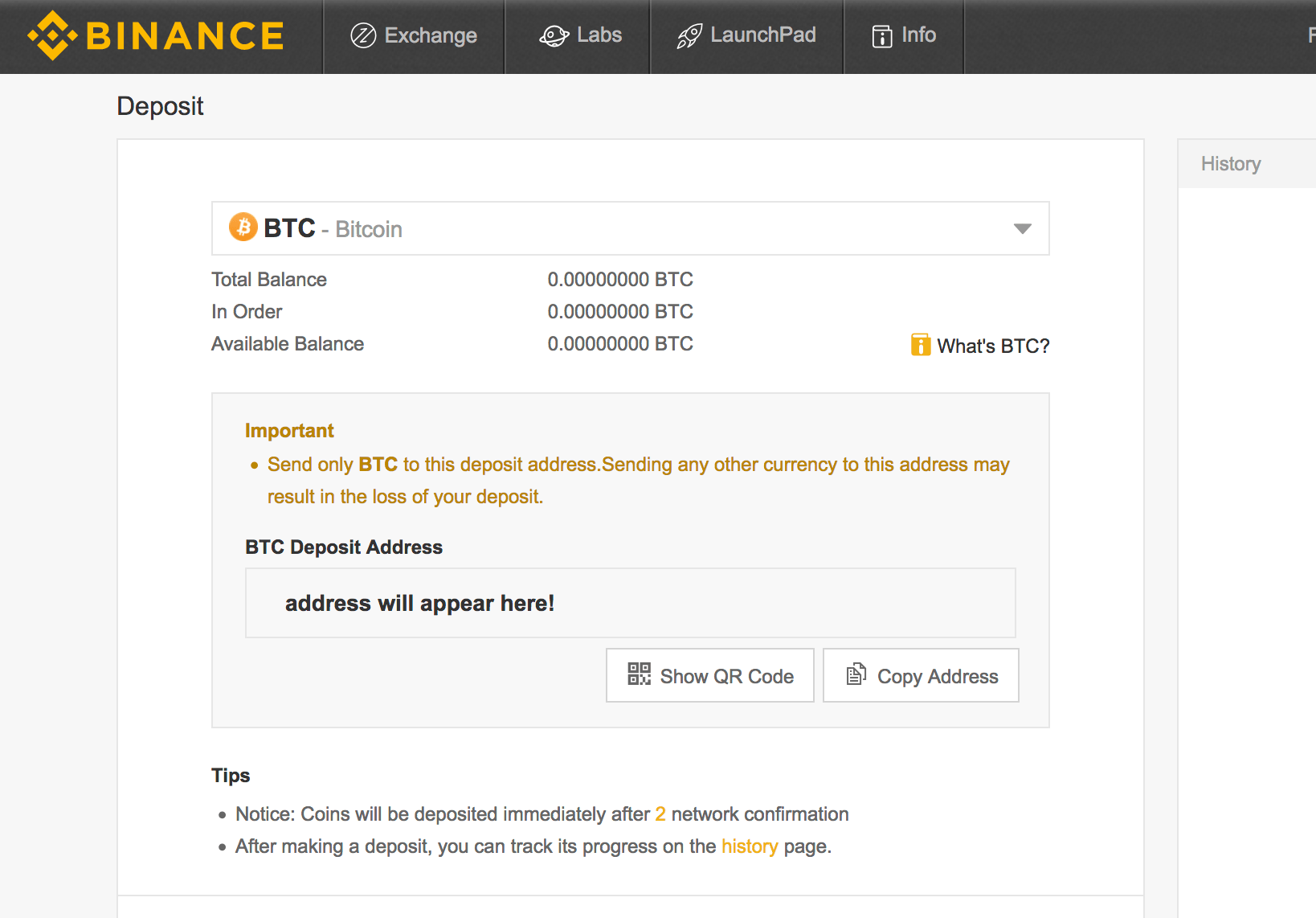

Marketing will likely be essential to your ability to succeed. Marketing and advertising is exactly what creates your leads. Without 바이낸스 거래 수수료 qualified prospects, you are not going to find great deals on components. For that reason, if anything will not be doing work in your expenditure strategy, consider your marketing strategy initially to discover what is happening and exactly what can be modified.

Speak to fellow real-estate traders. It's crucial that you reach out to other individuals and obtain assistance from those more capable than on your own. Their understanding can prevent you from generating errors and help save some cash. You can find lots of others through the Internet. Locate discussion boards to get productive on and find meetings in your area.

You really should use a property managing support. This may cost a tiny and definitely will help a lot in the end. These businesses will help you discover respectable tenants, plus care for any damages. This frees up time to consider a lot more attributes.

Don't get into real estate committing unless you're able to possess some backup funds. Spot dollars besides to cover slight fixes. Another good reason for experiencing additional money is in case you can't find a appropriate renter without delay. You continue to require to consider the price of property even though no person is residing there.

Try to find attributes which will be sought after. Actually end and consider what most people will likely be searching for. Search for relatively listed components on peaceful streets. Actively seeks residences with garages and 2 or 3 bedrooms. It's generally crucial that you think about precisely what the typical individual will be looking for in the home.

Reputation is very important from the making an investment world. As a result, constantly notify the simple truth and try not to make any foes. Most of all, follow-through on what you say you are likely to do. In case you are unsure whenever you can take action, usually do not create the state to begin with. Your track record could experience and affect your small business consequently.

Will be your area encountering a home worth improve? Will you see openings where the spots are being booked? These are some questions to ask on your own. You need to be sure you will discover a demand for leases in the community where you get.

Always display screen your renters. Understanding who you will be renting your attributes to is vital. Run a track record check out. Make sure they don't possess a spotty and unusual record with spending their rent on time. Finding out relating to your tenant's history can save you a great deal of problems later on.

Whenever you acquire real estate property, be careful not to more than-spend. You might be happier starting on a small scale than getting in over your face in the beginning. You don't want to diminish your price savings. Usually do not allow it to be your full-time career right away. After you have been effective, it is possible to change your method.

바낸 tempting to jump directly into the real estate market, but that approach could be very unsafe. Somewhat, you should begin with modest ventures, then improvement to greater investments. In this way, you are going to always have a monetary pillow and should never be washed out by 1 misstep or streak of poor market place good luck.

Stay away from any buzz regarding a a number of component of residence. It does not matter how very good the sales pitch appears to be. It is perfectly up to you to definitely do detailed research on the bit of residence to make certain that it really is effectively displayed. Getting property centered purely on buzz is surely an unwise selection.

Regular World wide web expense community forums. You may have the ability to discover a whole lot from those with many different experience. You will have a chance to make inquiries from people who have been making an investment for some time. This particular purchase local community is normally very supportive. New brokers typically discover these organizations to become incredibly useful.

Usually are aware of the risks that you are working with. Typically, the greater the danger, the bigger the potential payoff will probably be. But in addition to that higher risk also will come a bigger possibility of not making any cash in any way. So assess the danger stage and make sure it is within your comfort and ease region.

Look for purchases that provide income tax pros. Based on the expense enterprise, there could be particular taxes positive aspects. Connections are a great example of an investment that be appealing for the reason that benefits upon them could be taxes exempt. So aspect into all those conserving when determining the gains that the endeavor might have to suit your needs.

Make your anticipations reasonable. Don't depend on investments making you rich. That's an extremely improbable end result. Keep the objectives sensible ones. You may nonetheless make a considerable amount of cash off of assets, even if it is not likely to be a fortune. Congratulate your self for little positive results instead of permitting them to dissuade you.

Should you be buying shares, then keep yourself well-informed regarding how the highs and lows of your marketplace are. Then when your shares strike a "straight down" period, you will not be panicked and attempt to market confused. Taking your cash out too quickly is a very common mistake made by novice investors.

At some stage in your life you will consider a huge fiscal target you want to do in the considerably upcoming. This might be setting up your home ovum or sending a youngster to some fantastic school. It is possible to take on such costly targets by shelling out funds after a while. Make use of the intelligence and ideas on this article to make your upcoming dreams an increasing fact.