It's Great To Learn About Real Estate Property Committing

When you have any kind of very long-collection fiscal purpose in mind, making an investment is probably going to be required to achieve it. Regardless if your dream is retirement or delivering a kid to university, you are finest off of allowing your money expand by itself over time. Continue reading to learn some basic principles about making an investment your money.

Before you start committing, consider carry from the market and do your homework on properties. Look at among 50 and a 100 qualities in the community appealing. Do a comparison making use of excellent notice getting as well as a spread out page. Hire expectations, costs and restoration spending budgets needs to be aspects you're considering. This will help make a decision what bargains are the best.

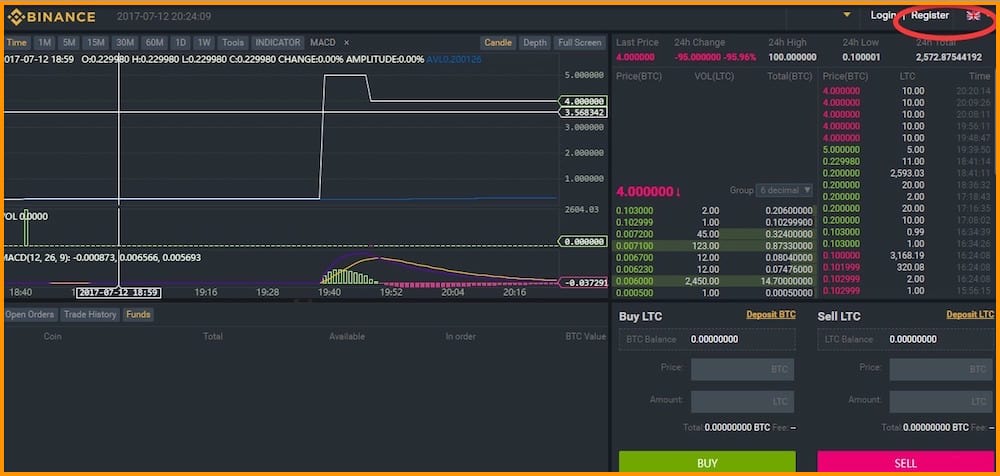

Advertising and marketing will be important to your success. Marketing and advertising is really what provides your qualified prospects. With out solid prospects, you are not going to find great deals on components. For 바이낸스 선물거래소 , if some thing is just not working in your purchase plan, turn to your marketing strategy first to find out what is going on and so what can be tweaked.

Speak to other real-estate traders. It's essential to get in touch with other people and obtain suggestions from all those more experienced than yourself. Their understanding can prevent you from producing blunders and help save some money. You can find numerous others through the Internet. Find discussion boards to get lively on and locate conferences in your town.

You may want to work with a residence control support. This will likely cost a little and can be very convenient in the end. These organizations will allow you to discover good tenants, plus take care of any problems. This liberates up time to find more components.

Don't get into real estate property investing unless you're able to incorporate some backup funds. Place dollars apart to pay for slight fixes. Another good cause of possessing additional money is in the event you can't look for a perfect renter as soon as possible. You will still need to have to contemplate the costs of residence even though no one is lifestyle there.

Look for components that might be sought after. Actually stop and take into consideration what a lot of people will probably be looking for. Try to find reasonably costed attributes on peaceful avenues. Actively seeks houses with garages and several sleeping rooms. It's usually crucial that you consider just what the typical person will be trying to find in the home.

Status is important in the committing planet. For that reason, usually tell the reality and do not make any opponents. Above all, follow through on what you say you might do. Should you be uncertain if you can do something, tend not to create the assert in the first place. Your status could suffer and affect your company for that reason.

Is your place encountering a home worth increase? Would you see vacancies the location where the spots are booked? These are a couple of questions to ask oneself. You need to make sure there exists a need for renting in the community where you buy.

Usually monitor your tenants. Understanding who you will be hiring your qualities to is vital. Operate a backdrop check out. Be sure they don't have a spotty and abnormal record with spending their hire by the due date. Discovering about your tenant's historical past can save you a lot of difficulty in the future.

Whenever you buy property, take care not to around-spend. You are better off beginning with a small scale than getting into above your head at the start. You don't wish to diminish your savings. Will not make it your fulltime work quickly. After you have been productive, you are able to revise your technique.

It's appealing to leap directly into the real estate industry, but that technique could be very dangerous. Quite, you can start with small assets, then progress to larger investments. In this way, you may generally have a financial cushioning and should never be cleaned out by one misstep or streak of awful market good luck.

Stay away from any hype regarding a specific bit of property. It makes no difference how excellent the sales hype sounds. It is up to anyone to do thorough study around the piece of residence to ensure that it can be precisely represented. Getting home based purely on hype is an foolish choice.

Frequent Internet expense community forums. You are going to have the ability to find out quite a lot from all those with lots of encounter. You will possess a chance to ask questions from individuals who have been making an investment for many years. This sort of expenditure local community is often really accommodating. New investors often get these teams to be extremely beneficial.

Generally know the risks that you will be working with. Normally, the greater the risk, the larger the potential payoff will be. But as well as that higher risk also arrives a bigger probability of not making any money by any means. So evaluate the risk degree and ensure it is with your comfort and ease region.

Search for investments offering taxes pros. Based on the expenditure endeavor, there could be particular taxation advantages. Bonds are an excellent illustration of an investment that be appealing because the gains about them might be tax exempt. So factor into individuals saving when examining the gains that the enterprise could have for yourself.

Keep the anticipations practical. Don't rely on purchases leading you to rich. That's an incredibly unlikely outcome. Maintain your expectations affordable types. You are able to nonetheless make a great deal of dollars off of assets, even when it is less likely to be a fortune. Congratulate on your own for small accomplishments rather than allowing them to discourage you.

When you are investing in stocks and shares, then keep yourself well-informed about how exactly the highs and lows in the marketplace are. Then when your stocks struck a "lower" period of time, you wont be panicked and attempt to sell at a loss. Pulling your hard earned dollars out too rapidly is a very common error made by amateur investors.

Sooner or later in your life you will think about big monetary purpose you want to do within the considerably long term. This can be setting up your nest ovum or delivering a kid into a fantastic university. You can take on this sort of high priced goals by committing funds after a while. Take advantage of the wisdom and concepts of this post to help make your long term desires an expanding actuality.