It's Great To Learn About Property Shelling out

For those who have just about any extended-variety economic objective in mind, making an investment is probably going to be essential to achieve it. No matter whether your dream is pension or delivering a kid to university, you are greatest off of allowing your hard earned money develop on its own after a while. Continue reading to find out some basic principles about making an investment your funds.

Before you start making an investment, take inventory from the market place and shop around on qualities. Have a look at among 50 plus a one hundred components in your community useful. Do a comparison using great take note consuming as well as a distribute page. Hire requirements, pricing and restoration financial budgets should be factors you're thinking of. This should help you choose what bargains are the most useful.

Marketing and advertising will be important to your prosperity. Marketing and advertising is really what creates your prospects. Without sound qualified prospects, you will not find good deals on components. Therefore, if anything is not really working in your investment program, consider your marketing strategy first to discover what is going on and exactly what can be adjusted.

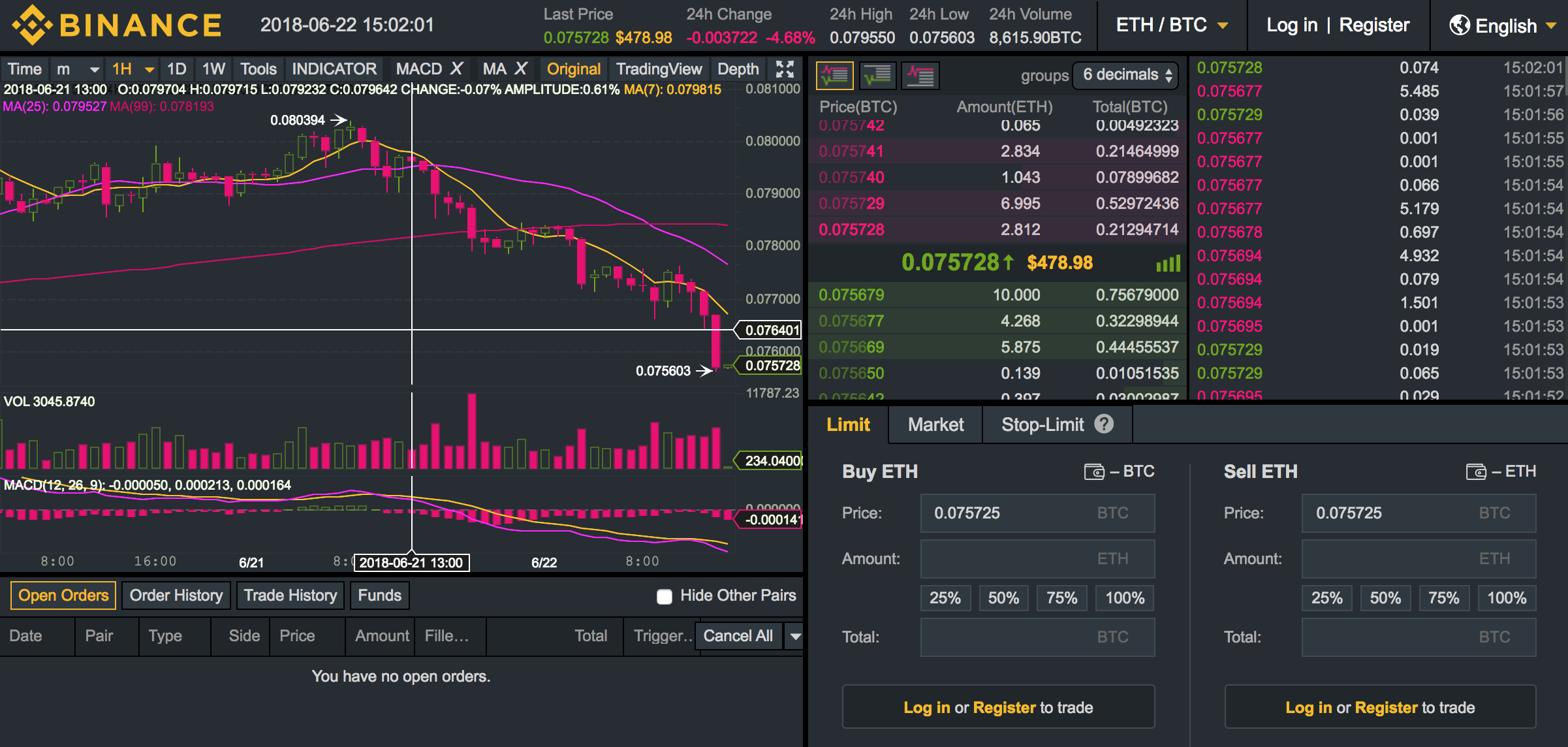

Speak to fellow property traders. It's vital that you reach out to others and obtain assistance from these more capable than oneself. Their understanding can stop you from making errors and help save you some money. 비트코인 선물거래소 사용법 can get lots of others through the Internet. Locate community forums to be active on and look for conferences in your neighborhood.

You may want to use a home managing service. This will likely cost a little but will be very convenient over time. These organizations can help you discover respectable renters, plus look after any damages. This frees up time to consider much more components.

Don't get into property shelling out unless of course you're able to have some back up income. Position cash away to purchase small maintenance. One additional basis for experiencing extra cash is in the event you can't get a perfect renter at the earliest opportunity. You still need to have to consider the costs of home even though no one is lifestyle there.

Look for attributes that might be in demand. Definitely end and think of what the majority of people is going to be looking for. Search for relatively costed qualities on calm roadways. Actively seeks houses with garages and 2 or 3 sleeping rooms. It's generally crucial that you think about just what the regular man or woman will likely be searching for at home.

Track record is important in the making an investment world. For that reason, constantly explain to the truth and try not to make any foes. Most of all, follow through on which you say you are going to do. When you are not sure provided you can take steps, usually do not make the claim in the first place. Your standing could endure and impact your small business because of this.

Is the region suffering from a home benefit increase? Would you see vacancies where the locations are booked? These are several things to ask on your own. You want to make sure you will discover a need for renting in your community for which you buy.

Constantly display your renters. Realizing who you are likely to be renting your qualities to is essential. Manage a track record verify. Ensure they don't possess a spotty and unusual historical past with paying their hire on time. Discovering about your tenant's history can help you save a great deal of trouble in the future.

Once you buy real estate, be careful not to above-invest. You will be more well off starting over a small scale than getting into more than the head at first. You don't desire to diminish your financial savings. Do not allow it to be your full-time task instantly. After you have been productive, you can modify your method.

It's luring to jump directly into real estate industry, but that strategy can be quite unsafe. Somewhat, you can start with modest assets, then advancement to larger assets. In this way, you are going to always have a monetary support and will not be washed out by one misstep or streak of awful market place good luck.

Beware of any hoopla about a particular piece of house. It does not matter how very good the sales pitch seems. It depends on you to definitely do thorough analysis around the component of house to make sure that it is effectively depicted. Getting house structured strictly on hype is undoubtedly an unwise option.

Regular Online expense discussion boards. You may have the capability to find out a great deal from all those with lots of experience. You will have the opportunity to ask questions from those who have been making an investment for some time. This kind of expense local community is usually very helpful. New brokers usually get these teams to be incredibly useful.

Generally are aware of the threats you are dealing with. Typically, the larger the chance, the larger the prospective payoff is going to be. But as well as that greater risk also is available a greater potential for not making any dollars by any means. So measure the danger stage and make sure it is with your ease and comfort zone.

Search for investments that supply income tax advantages. Depending on the expenditure endeavor, there could be certain income tax advantages. Connections are a wonderful demonstration of a smart investment that be appealing for the reason that gains about them might be income tax exempt. So aspect into these protecting when determining the profits a enterprise could have for you personally.

Keep the requirements practical. Don't rely on investments leading you to wealthy. That's an incredibly improbable outcome. Keep your anticipations sensible ones. You are able to nevertheless make plenty of funds off of investments, even should it be unlikely to become lot of money. Congratulate oneself for tiny accomplishments as opposed to letting them discourage you.

When you are making an investment in stocks and shares, then become knowledgeable regarding how the highs and lows from the market place are. Then when your shares success a "down" time period, you will not be panicked and try to offer at a loss. Taking your hard earned money out too rapidly is a common error manufactured by beginner investors.

At some point in your lifestyle you are going to think about a huge financial purpose you should do within the much potential. This can be creating your home egg cell or mailing a youngster to your wonderful institution. You may tackle this sort of pricey objectives by shelling out money with time. Take advantage of the knowledge and ideas with this report to help make your future dreams an expanding reality.